Connect metamask

Connect metamaskConnect your wallet

Connect metamask

Connect metamaskError with the transaction

Learn how to use the CDL Loans dapp

This dapp allows you to borrow tokens using other tokens as collateral. When you borrow funds, you have to repay more. The repayment fee increases the longer you want to borrow those funds.

You can only have 1 loan open at any given time. To open a new loan, repay the previous one first.

Right now there's a 0.07% fee per day borrowed, you must specify how long you want to borrow funds upfront and the fee will be fixed regardless how soon you repay the loan back. If you don't repay a loan after the specified time, your collateral will be consumed to repay liquidity providers.

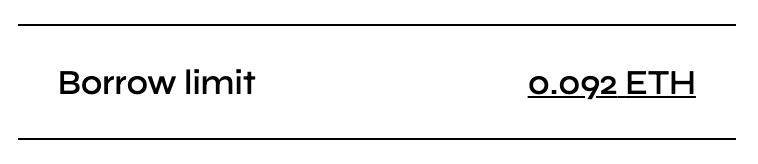

After adding collateral you'll see your "Borrow Limit" indicator increase, showing you the maximum amount of tokens you can borrow with that given collateral.

To start borrowing, simply open a token block and click on the "Borrow" button. A form will be opened so you can indicate how many funds you want to borrow and the number of days you require to repay it back. Remember to add collateral in the liquidity section beforehand to be able to borrow.

Once you confirm the metamask transaction, you'll see the amount to repay in the "Left to repay" indicator and the days left to repay that loan. Simply input the amount you wish to repay for that loan and click on the "Repay" button. Then confirm the metamask transactions to proceed.

Crypto ScoreEvery time you repay a loan, half of the repayment fee is used as your Crypto Score. Your Crypto Score is a number that indicates how many funds you can borrow without collateral. For instance, a Crypto Score of 100 will allow you to borrow 40 USDT tokens with no collateral.

Alternatively, you can use your Crypto Score to borrow an increased amount of tokens with less collateral. As you Crypto Score grows, you can borrow more funds with less or the same collateral.

This innovative system enables users to borrow money with no collateral in an 100% decentralized manner with no approvals required. Start building your Crypto Score now by getting and repaying loans back to benefit from higher borrow limits in the future!

Liquidity ProvisionYou can add liquidity to the token pools and earn an APY (return per year) on your funds. The APY depends entirely on the active loans at any given moment. The more people borrow your funds from every pool, the larger profit you'll earn.

All the liquidity given will be used as collateral, meaning you'll be able to use your liquidity to borrow funds from other token pools. Remember that if you use your liquidity to borrow funds, you'll stop earning an APY for that time until the loan is closed.

To start adding liquidity, open your desired token block and click on "Supply" after specifying how many tokens you want to supply to the liquidity pool. Then confirm the token approve metamask transaction and the supply transaction to proceed.

You can unstake your funds any time as long as they are not used as collateral for your loans. To do so, specify how many funds you want to withdraw in the liquidity section and click on "Withdraw".

Welcome to the CDL Loans Alpha!

This is an Alpha product fresh from the code factory. You should be aware of any potential issues and understand the risks involved in using it. You may lose your funds or encounter unexpected bugs and security issues. You're solely responsible for any funds lost given the potential security threats based on interacting with smart contracts. Only use what you can afford to lose. In any case, we're conducting a bug bounty and have completed a successful audit by Solidity Finance. If you have any suggestions or improvements, send us an email to yeld@yeld.finance or in our telegram group @yeldfinanceofficial